san francisco payroll tax and gross receipts

From imposing a single payroll tax to adding a gross receipts tax on. The California sales tax rate is currently 6.

San Francisco Taxes Filings Due February 28 2022 Pwc

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

. Ad Find 10 Best Payrolling Services Platforms. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. San Francisco businesses are also subject to annual.

In November 2012 San Francisco voters passed Proposition E The Gross Receipts Tax and Business Registration Fees Ordinance the Gross Receipts Tax. The minimum combined sales tax rate for San Francisco California is 85. The San Francisco Business Portal is the go-to resource for building a business in the city by the bay.

If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed executive pay ratio. The new Gross Receipts Tax and Business Registration Fees Ordinance which went into effect in 2014 is a significant change to the method in which payroll taxes are calculated and remitted to the city. In November of 2020 San Francisco voted to increase Gross Receipt Tax rates in a shift to do away with the payroll tax and slowly increase GRT by 40 in all industries up to 104 for some categories.

And Professional Scientific and Technical Services. The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6 2012. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

I couldnt figure out the total payroll for HashiCorp and Block or the average salary per employee but if you assume somewhere in the 100-150k range you see that the equivalent payroll tax rate for HashiCorp is. Depending on the business activity some rates for lower brackets of receipts will be temporarily reduced including for retail trade food services the arts manufacturing accommodations and certain services. Gross Receipts Tax Applicable to Financial Services.

The 2018 Payroll Expense Tax rate is 0380 percent. 10 2021 4 am. San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city.

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The san francisco office of the controller city and county of san francisco announced that for tax year 2018 the payroll expense tax rate is 038 down from 0711 for 2017. For example an entity with an executive pay ratio of greater than 2001 would pay a 02 overpaid executive tax rate.

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Starting in 2019 businesses will pay only the gross. San Francisco PayrollGross Receipts Tax Changes.

Under the new regulations a new gross receipts tax will be phased in while. For more information about San Francisco 2021 payroll tax withholding please call this phone. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses.

This exemption also applies to residential rental property owners with. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. From imposing a single payroll tax to adding a gross receipts tax on various real estate entities including commercial rentals and gathering funds to assist the homeless population.

Annual business registration fees. Due to all the changes many business owners are confused. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City.

The changes went into effect on January 1 2014 and it is important to be aware of the new tax and how it will affect your business. San Francisco taxes businesses based on gross receipts and payroll as well as business personal property like machinery equipment or fixtures. Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan.

The measure is intended to replace over time San Franciscos 15 payroll expense. Make Your Payroll Effortless and Focus on What really Matters. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went into effect on January 1 2014.

Interestingly San Franciscos gross receipts tax actually replaced a pre-2012 15 payroll tax on San Francisco employees. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. Responsive Easy-to-Use Try Now.

The Gross Receipts Tax has a small business exemption for businesses with no more than 1 million in gross receipts and businesses with less than 150000 of payroll. Feb 28Payroll Expense Tax and Gross Receipts Tax returns due. Greater than 3001 a 03 overpaid executive tax rate.

Gross Receipts Tax Applicable to Real Estate and Rental and Leasing Services. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their payroll expense.

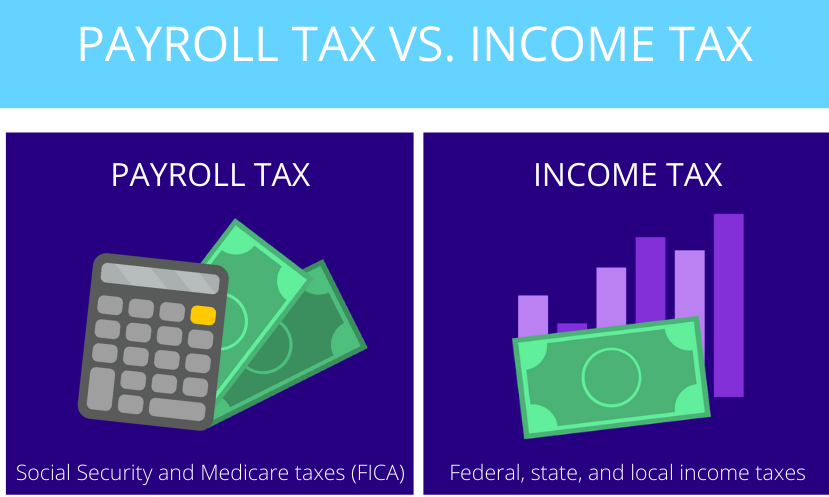

Therefore when you register for a San Francisco Business License you will become obligated for these local taxes. Tax year 2018 will be the last year of the payroll expense tax. Beginning in tax year 2014 for five years the San Francisco payroll expense tax rate will be incrementally reduced and the gross receipts tax rate will be correspondingly increased to allow time to adjust to the gross receipts tax.

Taxes Paid Filed - 100 Guarantee. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system.

Beginning in 2014 the calculation of the SF Payroll Tax changes in two significant ways. The citys gross receipts tax which remains a stealth payroll tax for most companies will become especially confounding as remote work grows. Ad Payroll So Easy You Can Set It Up Run It Yourself.

5 The current Payroll Expense Tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the City in 2018. In addition to transitioning from a Payroll Expense Tax to a Gross Receipts Tax Prop E also shifts the Citys Business Registration Fee to be measured by gross. The Payroll Expense Tax will not be phased out in 2018 as originally planned due to less-than-expected revenue from the Gross Receipts Tax.

6 The passage of Proposition F fully repeals the Citys Payroll Expense Tax which has existed. This is the total of state county and city sales tax rates. Businesses with operations in San Francisco are now subject to a new tax and registration structure.

1 the tax begins its transition to the gross receipts tax so there is a declining payroll tax component. It imposes an additional gross receipts tax of 01 to 06 on taxable gross receipts from businesses in which the highest-paid managerial employee earns more than 100 times the median compensation of employees based in San Francisco. Mar 31Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health.

City and County of San Francisco. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

Coronavirus Stimulus Checks What To Know About Mail Delivery Subscription Boxes For Kids Kids Boxing Credit Card Images

Employee Retention Tax Credit Office Of Economic And Workforce Development

Payroll Compliance And Tax Filing Services Rippling

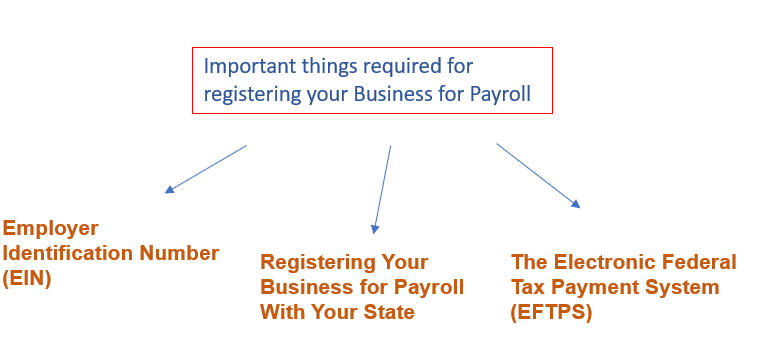

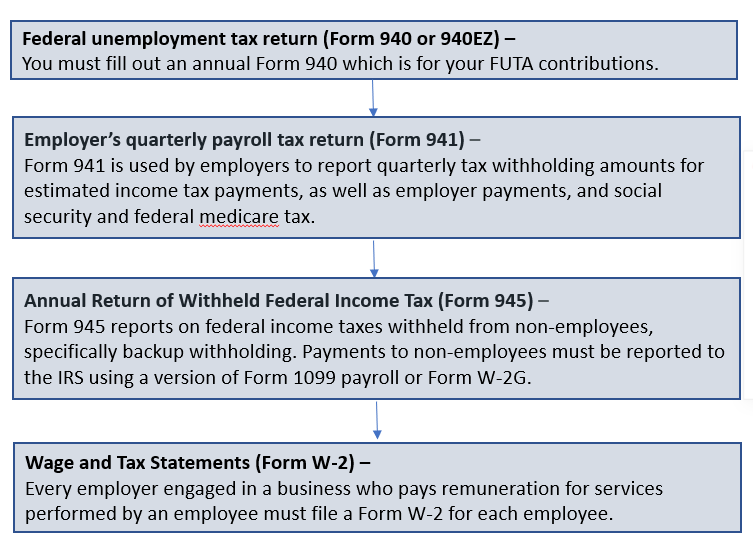

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Annual Business Tax Returns 2020 Treasurer Tax Collector

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Multnomah County Voters Reject Metro Payroll Tax Approve Universal Preschool Measure Kbf Cpas

San Francisco S New Local Tax Effective In 2022

San Francisco Gross Receipts Tax

Gross Receipts Tax And Payroll Expense Tax Sfgov

Annual Business Tax Returns 2021 Treasurer Tax Collector

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto